Introduction: The Quiet Force in Wealth Creation

As human beings, our brain is wired naturally to process and calculate linear extrapolations. For example, if my savings are $500 every month, then I can easily calculate in my mind that in 1 year I will have $6,000, in 2 years—$12,000, in 10 years—I would have accumulated $60,000, and so on. This is a simple linear growth model.

Now suppose my savings also grow at a modest 1% every month. At first glance, it may not seem to matter much. But that is because we are not wired "naturally" to think in terms of exponential growth.

If you use a calculator to compute the savings now, then it will come out to be a staggering $115,000 in 10 years!

That's nearly double the amount you had with linear growth. This is the power of compounding, and dividend reinvestment—as we will see, is a perfect example of how this principle works in the world of investing.

"Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn't, pays it"- Albert Einstein

In this article, we will explore how reinvesting dividends can significantly enhance total returns over time through the power of compounding.

There have been many studies that have delved into the decades of market data to uncover why this simple action has been responsible for a huge portion of the stock market's "total returns".

We will also look at some negatives of this technique so that you can make a more well-rounded and comprehensive strategy to harness the power of dividend reinvestment effectively.

The Compounding Engine: How Dividend Reinvestment Works

At its heart, dividend reinvestment is just the practical application of compound growth.

When you own a stock, you own a piece of a business. When that business earns a profit, it can choose to share a portion of it with you, its partial owner, in the form of a dividend.

You have two choices: take the cash, or reinvest it. Choosing to reinvest means you are systematically increasing your ownership stake in the company.

Let's walk through a simplified example. Imagine you invest $10,000 in a company, buying 100 shares at $100 each. The stock pays a 3% annual dividend.

- Year 1: You receive $300 in dividends ($3 per share). Instead of taking the cash, you reinvest it. If the share price is still $100, you buy 3 new shares. You now own 103 shares.

- Year 2: The company again pays a $3 per share dividend. But now, you receive $309 (103 shares x $3). You reinvest this to buy another 3.09 shares. You now own 106.09 shares.

- Year 3: Your dividend payment is now $318.27 (106.09 shares x $3). The cycle continues.

This might seem slow at first, but the effect accelerates dramatically over the long term. Your growing number of shares generates progressively larger dividend payments, which in turn buy even more shares.

This virtuous cycle is further amplified if the company also increases its dividend per share over time, a hallmark of a healthy, growing business. You get growth from two sources: more shares, and a higher payout per share.

In the world of investing, much attention is given to explosive growth stocks and complex trading strategies. Yet, this technique—one of the most powerful and reliable tools for wealth creation—operates quietly in the background, often overlooked.

The concept is very simple and straightforward: instead of pocketing the cash dividends your stocks pay you, you use them to automatically buy more shares of the same (or other) stock. This is dividend reinvestment, and it is the engine of compounding in its purest form.

Historical Data: How significant can dividend reinvestments be?

When you look at the charts and graphs of the stock market companies, you acknowledge the price appreciation that has occurred over time. But price appreciation alone gives a dangerously incomplete picture.

They overlook the importance of dividends and the "compounding effect" they create.

For this reason, you should look at the total returns of an investment, which includes both price appreciation and dividends.

There have been numerous studies and analyses done by financial institutions, especially when it comes to American stock markets, which consistently show two things:

- Dividend adjusted returns or total returns significantly dwarfs the returns from price appreciation alone, especially over the long term.

- Consistently dividend paying companies with decent growth have outperformed others while being less volatile.

A landmark study by Hartford Funds, analyzing S&P 500 data from 1960 to 2020, revealed an astonishing 84% of the S&P 500's total return in that 60 year time period came from reinvested dividends and the compounding of that capital. You can explore their findings in detail in their paper, "The Power of Dividends."

If you go and take a look at the slickcharts historical data for the S&P 500, you will see that the dividend return roughly contributes ~2% every year to the total return.

Again this may not seem like much, but this meagre 2% extra returns makes a huge difference when compounded over a long period of time.

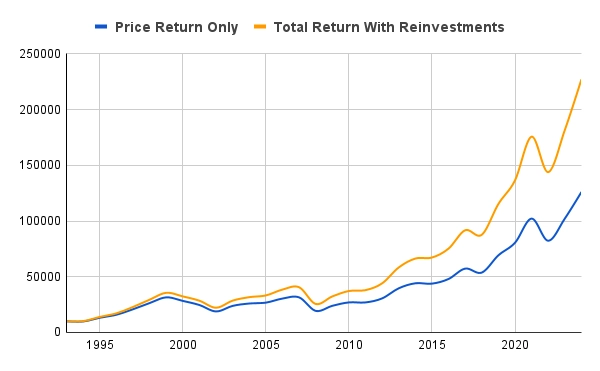

For instance, suppose you started investment at age around 25-30 for the next 30 years. If we go backdate and compare what the past 30 years (from 1993-2023) have yielded with or without dividends reinvested from that same S&P 500 data, then the difference is 1160% without dividends to a whooping 2172% returns with dividends reinvested. Thats nearly a 1000% outperformance!

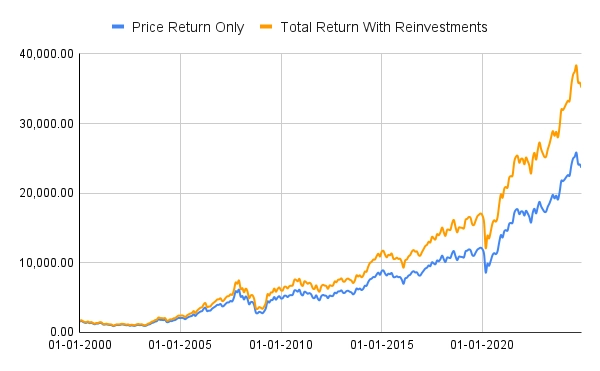

Similarly for Indian stock markets, from Jan-2000 to Dec-2024, the Nifty 50 index has returned 1430% without dividends reinvested, but a 2044% with dividends reinvested. That's again a huge difference of more than 600% in 25 year period, a period over which most of us invest.

The importance of dividends becomes even more pronounced during periods of flat or declining markets. In "lost decades" like the 2000s, the S&P 500's price return was actually negative. However, investors who patiently reinvested their dividends still managed to eke out a positive total return for the decade. Dividends provided the only source of growth when capital appreciation was absent.

This isn't just an index-level phenomenon. Consider a real-world example like the consumer goods giant Procter & Gamble (PG), a "Dividend King" that has increased its dividend for over 65 consecutive years. An investment of $10,000 in PG in 1995 would have grown to about $80,000 by 2025 based on price alone. With dividends reinvested, that figure would be closer to $190,000. Here again, the reinvestment strategy more than doubled the final outcome.

Strategic Implementation: How to Reinvest Effectively

The most common method is to simply turn on the automatic DRIP feature offered by most brokerages, and many individual companies as well, in your brokerage account. This is a fantastic "set it and forget it" approach that enforces discipline and leverages several key benefits.

These plans often come with the added benefits of no commission fees and the ability to purchase even "fractional" shares, ensuring every single cent of your dividend is put back to work immediately.

Here are some of the key advantages of using a DRIP:

- Automated discipline: Reinvesting dividends forces you to buy shares at regular intervals all the while ignoring market noise and maintaining discipline.

- Psychological Fortitude: During a market crash, seeing your portfolio's value drop is painful. However, a dividend-focused mindset can reframe this. Instead of seeing a loss, you see an opportunity. The dividends you receive are now buying shares at a discount, accelerating your ownership stake. This focus on share accumulation, rather than short-term price fluctuation, can be a powerful psychological anchor in turbulent times.

- As stated automatic DRIPs are typically commission-free. This ensures that 100% of your dividend income is put to work, maximizing efficiency and removing the behavioral barrier of having to make a manual trade.

The alternative strategy is to collect all dividends as cash in your account. Then periodically, you manually reinvest that pooled cash into what you believe is the most undervalued security in your portfolio at that moment. Thus, you need not reinvest into the same company that yielded the dividend.

This alternative method requires more work but it allows more freedom and an optimised capital allocation provided you maintain the discipline.

Practical Considerations: Taxes, Concentration, and Your Stage of Life

While dividend reinvestment is a powerful strategy, it's not without its complexities. The most significant consideration, especially for investments held in a standard taxable brokerage account, is taxes.

Even if you automatically reinvest a dividend and never see the cash, taxation laws in most countries still consider it income in the year it was paid. You will owe taxes on that dividend income.

For this reason, many people implement dividend reinvestment strategies inside tax-advantaged accounts like Roth IRAs in the US or ELSS funds in India. This can be incredibly efficient, as the dividends can grow and compound either tax-free or tax-deferred.

Another key consideration is to be aware of concentration risk. If you continuously reinvest dividends into a stock that has performed exceptionally well, that particular stock may become an oversized portion of your portfolio.

While this feels great on the way up, it exposes you to significant risk if that one company's fortunes were to reverse. It's crucial to monitor your portfolio's allocation and periodically rebalance—which might mean selling some of your winners—to maintain proper diversification.

Finally, your stage in life matters. Dividend reinvestment is a strategy for the accumulation phase, when your goal is to grow your capital base. As you approach or enter retirement—the distribution phase—your goals shift. You may want to start taking those dividends as income rather than reinvesting them.

If you have been investing for a long time, then years of reinvesting should have already built a much larger base of shares, which should generate a good stream of cash income for you to live on.

Conclusion

The strategy of dividend investing is not flashy, it doesn’t promise overnight riches, but for the patient, long-term value investor, it can be one of the most effective tools for building substantial wealth.

This isn't just a minor portfolio tweak; it's a fundamental shift in how your investments grow. It transforms a portfolio from a simple asset that appreciates in value into a self-sustaining system that actively accelerates its own growth.

Each dividend payment, no matter how small, becomes a seed that grows into a new income-producing asset. Over time, this creates a snowball effect of staggering proportions.

While media pundits and market noise often emphasize capital appreciation returns, the historical data is unequivocal— a significant portion of the market's long-term returns is attributable not to rising prices alone, but to the steady, systematic reinvestment of dividends.

By embracing this strategy, you align yourself with the fundamental principles of value investing: focusing on the long term, leveraging the productive power of the underlying businesses, and allowing the magic of compounding to be your greatest ally.

Happy investing!

Comments